“The free market punishes irresponsibility. Government rewards it."

-Harry Browne

Wednesday, December 30, 2009

Tuesday, December 15, 2009

Christmas Shopping, Stereo System: 1958 v. 2009

Christmas Shopping, Stereo System: 1958 v. 2009: " In 1958, the “best stereo sound equipment' Sears had to offer was advertised for sale in its Christmas catalog for $84.95 (pictured on left above), boasting that “You’ll be amazed at the ‘living sound’ you’ll hear on this newest development in portable phonographs. Four tubes per rectifier. Hear every note, every shading of tone.”

I doubt anybody today would be too amazed at the sound quality of that 1958 state-of-the-art stereo equipment, and nobody would trade his or her iPod for that system, especially considering that the 'time cost' of today’s iPod (12.51 hours of work at today’s average hourly manufacturing wage of $18.59 to earn enough income [ignoring taxes] to purchase a $229.99 iPod at Wal-Mart ) is almost 71 percent cheaper than Sears’ best stereo equipment in 1958 for (42.9 hours of work at the average wage of $1.98 per hour to earn enough income to purchase the $84.95 stereo in 1958).

Read more here at the Enterprise Blog. "

"

Steve: Not to mention the iPod is mobile and holds a lot more music.

I doubt anybody today would be too amazed at the sound quality of that 1958 state-of-the-art stereo equipment, and nobody would trade his or her iPod for that system, especially considering that the 'time cost' of today’s iPod (12.51 hours of work at today’s average hourly manufacturing wage of $18.59 to earn enough income [ignoring taxes] to purchase a $229.99 iPod at Wal-Mart ) is almost 71 percent cheaper than Sears’ best stereo equipment in 1958 for (42.9 hours of work at the average wage of $1.98 per hour to earn enough income to purchase the $84.95 stereo in 1958).

Read more here at the Enterprise Blog.

Steve: Not to mention the iPod is mobile and holds a lot more music.

Friday, December 4, 2009

Economic Alert

Unemployment Rate (United States) {US} OBSERVATION PERIOD: NOV (Monthly)

ACTUAL : 10.0%

PRIOR : 10.2%

REVISED : - -

SURVEY : 10.2% (Mean: 10.2%, High: 10.4%, Low: 9.9%)

Change in Nonfarm Payrolls (United States) {US} OBSERVATION PERIOD: NOV (Monthly)

ACTUAL : -11K

PRIOR : -190K

REVISED : -111K

SURVEY : -125K (Mean: -121K, High: -30K, Low: -185K)

Average Weekly Hours (United States) {US} OBSERVATION PERIOD: NOV (Monthly)

ACTUAL : 33.2

PRIOR : 33.0

REVISED : - -

SURVEY : 33.1 (Mean: 33.1, High: 33.1, Low: 33.0)

Unemployment rate falls to 10% in November. Nonfarm payrolls dropped by 11,000 in November, a number not seen since December 2007. Also, September and October numbers were revised lower by a total of 159,000. Economist expected a loss of 125,000 jobs in November. Futures spiked after the report.

ACTUAL : 10.0%

PRIOR : 10.2%

REVISED : - -

SURVEY : 10.2% (Mean: 10.2%, High: 10.4%, Low: 9.9%)

Change in Nonfarm Payrolls (United States) {US} OBSERVATION PERIOD: NOV (Monthly)

ACTUAL : -11K

PRIOR : -190K

REVISED : -111K

SURVEY : -125K (Mean: -121K, High: -30K, Low: -185K)

Average Weekly Hours (United States) {US} OBSERVATION PERIOD: NOV (Monthly)

ACTUAL : 33.2

PRIOR : 33.0

REVISED : - -

SURVEY : 33.1 (Mean: 33.1, High: 33.1, Low: 33.0)

Unemployment rate falls to 10% in November. Nonfarm payrolls dropped by 11,000 in November, a number not seen since December 2007. Also, September and October numbers were revised lower by a total of 159,000. Economist expected a loss of 125,000 jobs in November. Futures spiked after the report.

Wednesday, November 25, 2009

Economic Alert

Initial Jobless Claims (United States) {US} OBSERVATION PERIOD: NOV 21 (Weekly)

ACTUAL : 466K

PRIOR : 505K

REVISED : 501K

SURVEY : 500K (Mean: 496K, High: 512K, Low: 460K)

Continuing Claims (United States) {US} OBSERVATION PERIOD: NOV 14 (Weekly)

ACTUAL : 5423K

PRIOR : 5611K

REVISED : 5613K

SURVEY : 5565K (Mean: 5559K, High: 5630K, Low: 5400K)

Personal Income (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 0.2%

PRIOR : 0.0%

REVISED : 0.2%

SURVEY : 0.1% (Mean: 0.1%, High: 0.4%, Low: -0.2%)

Personal Spending (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 0.7%

PRIOR : -0.5%

REVISED : -0.6%

SURVEY : 0.5% (Mean: 0.5%, High: 0.8%, Low: 0.0%)

Durable Goods Orders (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -0.6%

PRIOR : 1.0%

REVISED : 2.0%

SURVEY : 0.5% (Mean: 0.5%, High: 2.1%, Low: -1.0%)

Durables Ex Transportation (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -1.3%

PRIOR : 0.9%

REVISED : 1.8%

SURVEY : 0.7% (Mean: 0.7%, High: 1.5%, Low: -0.6%)

The number of initial unemployment claims dropped to a seasonally adjusted 466,000 in the week ending Nov. 21. This marks the lowest level of filings for initial claims in over a year, finally breaking the 500,000 mark. Continuing claims were also below analyst expectations. They came in at 5,423,000 compared to an estimated 5,565,000. Some of which may be attributable to seasonal part-time employment.

Personal income rose 0.2% for the second straight month, slightly better than expected. Spending increased 0.7% for the month, showing that the consumer is still spending despite the unclear future of the economy. Personal spending grew faster than income, therefore Americans' personal savings rate dipped to 4.4% in October from 4.6% in September.

However, the durable goods order was somewhat disappointing. New orders for durable (long-lasting) U.S. manufactured goods fell in october. Durable good orders are a leading indicator of manufacturing activity.

ACTUAL : 466K

PRIOR : 505K

REVISED : 501K

SURVEY : 500K (Mean: 496K, High: 512K, Low: 460K)

Continuing Claims (United States) {US} OBSERVATION PERIOD: NOV 14 (Weekly)

ACTUAL : 5423K

PRIOR : 5611K

REVISED : 5613K

SURVEY : 5565K (Mean: 5559K, High: 5630K, Low: 5400K)

Personal Income (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 0.2%

PRIOR : 0.0%

REVISED : 0.2%

SURVEY : 0.1% (Mean: 0.1%, High: 0.4%, Low: -0.2%)

Personal Spending (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 0.7%

PRIOR : -0.5%

REVISED : -0.6%

SURVEY : 0.5% (Mean: 0.5%, High: 0.8%, Low: 0.0%)

Durable Goods Orders (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -0.6%

PRIOR : 1.0%

REVISED : 2.0%

SURVEY : 0.5% (Mean: 0.5%, High: 2.1%, Low: -1.0%)

Durables Ex Transportation (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -1.3%

PRIOR : 0.9%

REVISED : 1.8%

SURVEY : 0.7% (Mean: 0.7%, High: 1.5%, Low: -0.6%)

The number of initial unemployment claims dropped to a seasonally adjusted 466,000 in the week ending Nov. 21. This marks the lowest level of filings for initial claims in over a year, finally breaking the 500,000 mark. Continuing claims were also below analyst expectations. They came in at 5,423,000 compared to an estimated 5,565,000. Some of which may be attributable to seasonal part-time employment.

Personal income rose 0.2% for the second straight month, slightly better than expected. Spending increased 0.7% for the month, showing that the consumer is still spending despite the unclear future of the economy. Personal spending grew faster than income, therefore Americans' personal savings rate dipped to 4.4% in October from 4.6% in September.

However, the durable goods order was somewhat disappointing. New orders for durable (long-lasting) U.S. manufactured goods fell in october. Durable good orders are a leading indicator of manufacturing activity.

Tuesday, November 24, 2009

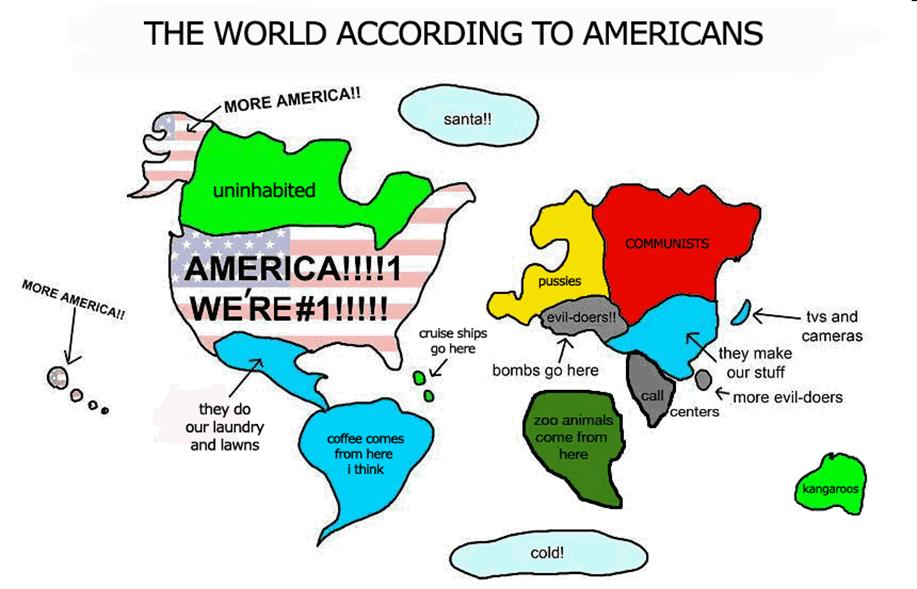

The World According to Americans

The World According to Americans: "

"

This got big laughs in Berlin (despite the description of Europe)

>

Hat tip Prieur!

Hat tip Prieur!

>

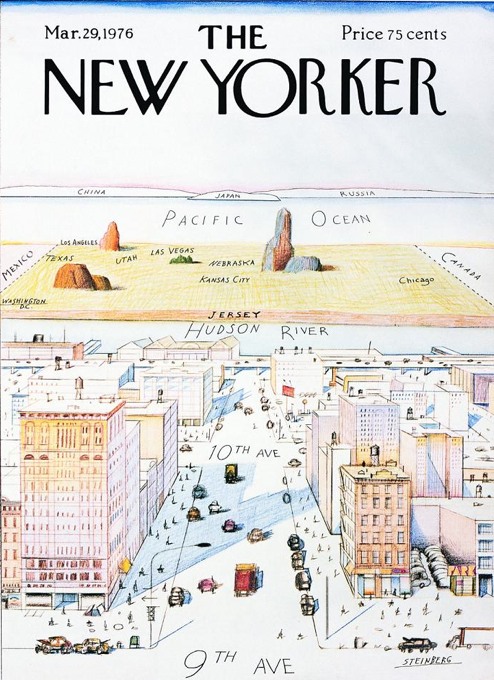

Not to be confused with Saul Steinberg’s New Yorker cover (March 29, 1976) “View of the World from 9th Avenue.”

"

Thursday, November 19, 2009

Leading Indicators Rise for 7th Month to 2-Yr. High

Leading Indicators Rise for 7th Month to 2-Yr. High: "

Details:

Six of the ten indicators that make up The Conference Board LEI for the U.S. increased in October. The positive contributors – beginning with the largest positive contributor – were the interest rate spread, average weekly initial claims for unemployment insurance (inverted), stock prices, average weekly manufacturing hours, real money supply and manufacturers’ new orders for consumer goods and materials. The negative contributors – beginning with the largest negative contributor – were index of consumer expectations, building permits, index of supplier deliveries (vendor performance), and manufacturers’ new orders for nondefense capital goods. "

"

The Leading Economic Index (LEI) increased for the 7th straight month to 103.8, the highest level since the fall of 2007, and the first time in more than five years of 7-consecutive monthly increases (since early 2004).

Details:

Six of the ten indicators that make up The Conference Board LEI for the U.S. increased in October. The positive contributors – beginning with the largest positive contributor – were the interest rate spread, average weekly initial claims for unemployment insurance (inverted), stock prices, average weekly manufacturing hours, real money supply and manufacturers’ new orders for consumer goods and materials. The negative contributors – beginning with the largest negative contributor – were index of consumer expectations, building permits, index of supplier deliveries (vendor performance), and manufacturers’ new orders for nondefense capital goods.

Wednesday, November 18, 2009

Baltic Dry Index Roars Back: 102.5% Gain in 39 Days

Posted my Mark J. Perry at Carpe Diem.

Baltic Dry Index Roars Back: 102.5% Gain in 39 Days: " The Baltic Dry Index closed today at 4381, advancing for the 14th straight day, and registering positive gains in 31 out the last 35 days. From the late-September low of 2163, the benchmark index for freight costs to ship dry bulk commodities such as iron ore, coal and grains has more than doubled in just 39 days, and has reached the highest level since September 24, 2008, almost 14 months ago. The global economic recovery is underway and gaining momentum.

The Baltic Dry Index closed today at 4381, advancing for the 14th straight day, and registering positive gains in 31 out the last 35 days. From the late-September low of 2163, the benchmark index for freight costs to ship dry bulk commodities such as iron ore, coal and grains has more than doubled in just 39 days, and has reached the highest level since September 24, 2008, almost 14 months ago. The global economic recovery is underway and gaining momentum.

See related post here from Scott Grannis, who says that:

Clearly, the wheels of global commerce are spinning back up. Everything I see is consistent with a global recovery in confidence, in demand, and in production. "

"

Baltic Dry Index Roars Back: 102.5% Gain in 39 Days: "

The Baltic Dry Index closed today at 4381, advancing for the 14th straight day, and registering positive gains in 31 out the last 35 days. From the late-September low of 2163, the benchmark index for freight costs to ship dry bulk commodities such as iron ore, coal and grains has more than doubled in just 39 days, and has reached the highest level since September 24, 2008, almost 14 months ago. The global economic recovery is underway and gaining momentum.

The Baltic Dry Index closed today at 4381, advancing for the 14th straight day, and registering positive gains in 31 out the last 35 days. From the late-September low of 2163, the benchmark index for freight costs to ship dry bulk commodities such as iron ore, coal and grains has more than doubled in just 39 days, and has reached the highest level since September 24, 2008, almost 14 months ago. The global economic recovery is underway and gaining momentum.See related post here from Scott Grannis, who says that:

Clearly, the wheels of global commerce are spinning back up. Everything I see is consistent with a global recovery in confidence, in demand, and in production.

Subscribe to:

Comments (Atom)