Every aspect of our lives is fueled by markets. Market Fueled is a compilation of market driven ideas and knowledge. It will consist of shared posts and links from my favorite blogs, articles, and some of my own ideas. The focus of the blog will be economics, financial markets, politics, and technology.

Wednesday, December 30, 2009

Tuesday, December 15, 2009

Christmas Shopping, Stereo System: 1958 v. 2009

I doubt anybody today would be too amazed at the sound quality of that 1958 state-of-the-art stereo equipment, and nobody would trade his or her iPod for that system, especially considering that the 'time cost' of today’s iPod (12.51 hours of work at today’s average hourly manufacturing wage of $18.59 to earn enough income [ignoring taxes] to purchase a $229.99 iPod at Wal-Mart ) is almost 71 percent cheaper than Sears’ best stereo equipment in 1958 for (42.9 hours of work at the average wage of $1.98 per hour to earn enough income to purchase the $84.95 stereo in 1958).

Read more here at the Enterprise Blog.

Steve: Not to mention the iPod is mobile and holds a lot more music.

Friday, December 4, 2009

Economic Alert

ACTUAL : 10.0%

PRIOR : 10.2%

REVISED : - -

SURVEY : 10.2% (Mean: 10.2%, High: 10.4%, Low: 9.9%)

Change in Nonfarm Payrolls (United States) {US} OBSERVATION PERIOD: NOV (Monthly)

ACTUAL : -11K

PRIOR : -190K

REVISED : -111K

SURVEY : -125K (Mean: -121K, High: -30K, Low: -185K)

Average Weekly Hours (United States) {US} OBSERVATION PERIOD: NOV (Monthly)

ACTUAL : 33.2

PRIOR : 33.0

REVISED : - -

SURVEY : 33.1 (Mean: 33.1, High: 33.1, Low: 33.0)

Unemployment rate falls to 10% in November. Nonfarm payrolls dropped by 11,000 in November, a number not seen since December 2007. Also, September and October numbers were revised lower by a total of 159,000. Economist expected a loss of 125,000 jobs in November. Futures spiked after the report.

Wednesday, November 25, 2009

Economic Alert

ACTUAL : 466K

PRIOR : 505K

REVISED : 501K

SURVEY : 500K (Mean: 496K, High: 512K, Low: 460K)

Continuing Claims (United States) {US} OBSERVATION PERIOD: NOV 14 (Weekly)

ACTUAL : 5423K

PRIOR : 5611K

REVISED : 5613K

SURVEY : 5565K (Mean: 5559K, High: 5630K, Low: 5400K)

Personal Income (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 0.2%

PRIOR : 0.0%

REVISED : 0.2%

SURVEY : 0.1% (Mean: 0.1%, High: 0.4%, Low: -0.2%)

Personal Spending (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 0.7%

PRIOR : -0.5%

REVISED : -0.6%

SURVEY : 0.5% (Mean: 0.5%, High: 0.8%, Low: 0.0%)

Durable Goods Orders (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -0.6%

PRIOR : 1.0%

REVISED : 2.0%

SURVEY : 0.5% (Mean: 0.5%, High: 2.1%, Low: -1.0%)

Durables Ex Transportation (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -1.3%

PRIOR : 0.9%

REVISED : 1.8%

SURVEY : 0.7% (Mean: 0.7%, High: 1.5%, Low: -0.6%)

The number of initial unemployment claims dropped to a seasonally adjusted 466,000 in the week ending Nov. 21. This marks the lowest level of filings for initial claims in over a year, finally breaking the 500,000 mark. Continuing claims were also below analyst expectations. They came in at 5,423,000 compared to an estimated 5,565,000. Some of which may be attributable to seasonal part-time employment.

Personal income rose 0.2% for the second straight month, slightly better than expected. Spending increased 0.7% for the month, showing that the consumer is still spending despite the unclear future of the economy. Personal spending grew faster than income, therefore Americans' personal savings rate dipped to 4.4% in October from 4.6% in September.

However, the durable goods order was somewhat disappointing. New orders for durable (long-lasting) U.S. manufactured goods fell in october. Durable good orders are a leading indicator of manufacturing activity.

Tuesday, November 24, 2009

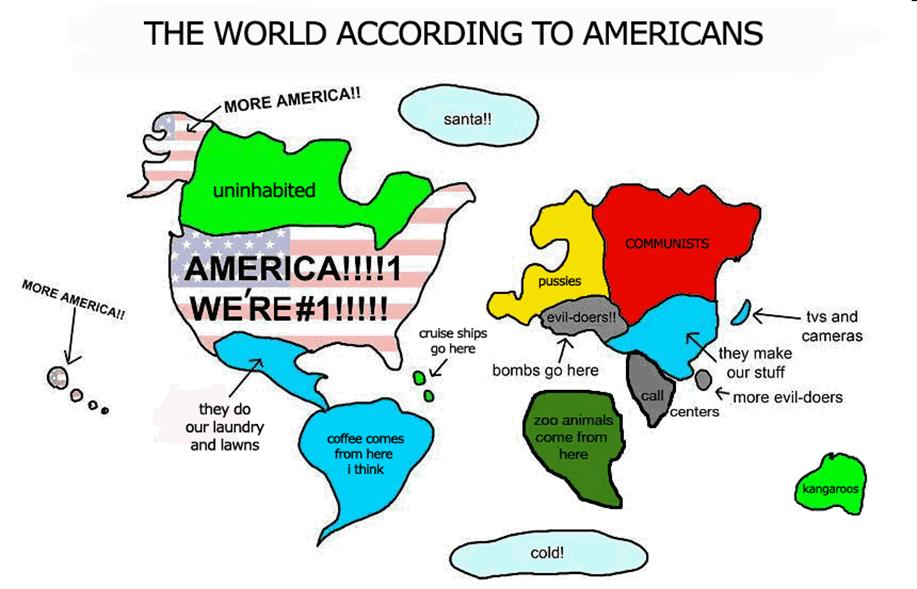

The World According to Americans

This got big laughs in Berlin (despite the description of Europe)

>

Hat tip Prieur!

Hat tip Prieur!

>

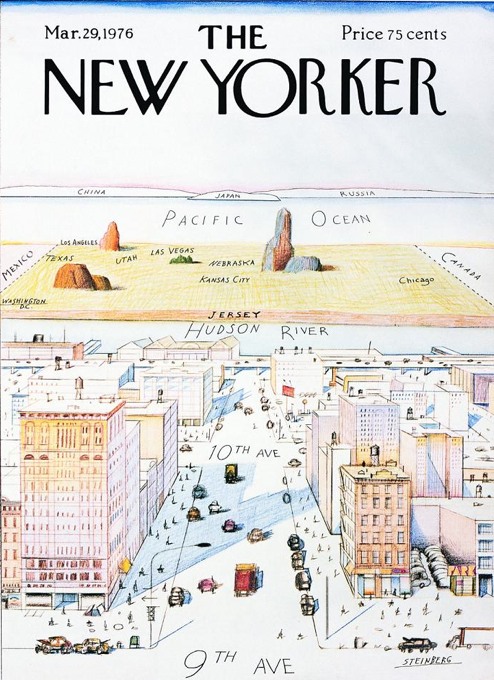

Not to be confused with Saul Steinberg’s New Yorker cover (March 29, 1976) “View of the World from 9th Avenue.”

"

Thursday, November 19, 2009

Leading Indicators Rise for 7th Month to 2-Yr. High

Details:

Six of the ten indicators that make up The Conference Board LEI for the U.S. increased in October. The positive contributors – beginning with the largest positive contributor – were the interest rate spread, average weekly initial claims for unemployment insurance (inverted), stock prices, average weekly manufacturing hours, real money supply and manufacturers’ new orders for consumer goods and materials. The negative contributors – beginning with the largest negative contributor – were index of consumer expectations, building permits, index of supplier deliveries (vendor performance), and manufacturers’ new orders for nondefense capital goods.

Wednesday, November 18, 2009

Baltic Dry Index Roars Back: 102.5% Gain in 39 Days

Baltic Dry Index Roars Back: 102.5% Gain in 39 Days: "

The Baltic Dry Index closed today at 4381, advancing for the 14th straight day, and registering positive gains in 31 out the last 35 days. From the late-September low of 2163, the benchmark index for freight costs to ship dry bulk commodities such as iron ore, coal and grains has more than doubled in just 39 days, and has reached the highest level since September 24, 2008, almost 14 months ago. The global economic recovery is underway and gaining momentum.

The Baltic Dry Index closed today at 4381, advancing for the 14th straight day, and registering positive gains in 31 out the last 35 days. From the late-September low of 2163, the benchmark index for freight costs to ship dry bulk commodities such as iron ore, coal and grains has more than doubled in just 39 days, and has reached the highest level since September 24, 2008, almost 14 months ago. The global economic recovery is underway and gaining momentum.See related post here from Scott Grannis, who says that:

Clearly, the wheels of global commerce are spinning back up. Everything I see is consistent with a global recovery in confidence, in demand, and in production.

Sunday, November 15, 2009

The "Good Old Days" Are Now and It Gets Better All the Time, Thanks to Free-Market Capitalism

From the BLS report '100 Years of U.S. Consumer Spending':

From the BLS report '100 Years of U.S. Consumer Spending':

1. The material well-being of families in the United States improved dramatically, as demonstrated by the change over time in the percentage of expenditures allocated for food, clothing, and housing. In 1901, the average U.S. family devoted 79.8 percent of its spending to these necessities. By 2002–03, allocations on necessities had been reduced substantially, for U.S. families to 50.1% of spending (see top chart above).

2. The continued and significant decline over the century in the share of expenditures allocated for food also reflected improved living standards. In 1901, U.S. households allotted 42.5% of their expenditures for food; by 2002–03, food’s share of spending had dropped to just 13.2%.

3. Over the 100-year period, expenditure shares for clothing steadily declined. In 1901, the average U.S. household allocated 14% of total spending for apparel. By 2002–03, spending shares for clothing had decreased to 4.2%.

4. In 2002–03, the average U.S. family could allocate about 50% ($20,333) of total expenditures for a variety of discretionary consumer goods and services, while the average family in 1901 could allocate only 20.2%, or $155, for discretionary spending (see bottom chart above).

Conclusion: Perhaps as revealing as the shift in consumer expenditure shares over the past 100 years is the wide variety of consumer items that had not been invented during the early decades of the 20th century but are commonplace today. In the 21st century, households throughout the country have purchased computers, televisions, iPods, DVD players, vacation homes, boats, planes, and recreational vehicles. They have sent their children to summer camps; contributed to retirement and pension funds; attended theatrical and musical performances and sporting events; joined health, country, and yacht clubs; and taken domestic and foreign vacation excursions. These items, which were unknown and undreamt of a century ago, are tangible proof that U.S. households today enjoy a higher standard of living.

MP: As I wrote in a previous post: Teenagers today can afford products today like cell phones with cameras, digital cameras, GPS systems, CD players, DVD players, laptop computers, and iPods that even a billionaire couldn't have purchased 2 0 years ago. As much as we might complain, just by being alive in the 21st century America, even if you're earning the minimum wage, you've already 'won first prize in the lottery of life.'

HT: Lyle Meier

Friday, November 6, 2009

Public Option = Single Payer = Gov't. Monopoly

If the government has some magic way of reducing costs — rather than shifting them around, including shifting them to the next generation — they have certainly not revealed that secret. The actual track record of government when it comes to costs — of anything — is more alarming than reassuring.

2. Ironically, it is politicians who have already made medical insurance so expensive that many people refuse to buy it. Insurance is designed to cover risk. But politicians have mandated that insurance cover things that are not risks and that neither the buyers nor the sellers of insurance want covered.

In various states, medical insurance must cover the costs of fertility treatments, annual checkups and other things that have nothing to do with risks. What many people most want is to be insured against the risk of having their life's savings wiped out by a catastrophic illness. But you cannot get insurance just for catastrophic illnesses when politicians keep piling on mandates that drive up the cost of the insurance. These are usually state mandates but the federal government is already promising more mandates on insurance companies — which means still higher costs and higher premiums.

All this makes a farce of the notion of a 'public option' that will simply provide competition to keep private insurance companies honest. What politicians can and will do is continue to drive up the cost of private insurance until it is no longer viable. A 'public option' is simply a path toward a 'single payer' system, a euphemism for a government monopoly.

~Thomas Sowell's latest column on the 'costs' of medical care.

Unemployment Rate Climbs

ACTUAL : 10.2%

PRIOR : 9.8%

REVISED : - -

SURVEY : 9.9% (Mean: 9.9%, High: 10.1%, Low: 9.8%)

Change in Nonfarm Payrolls (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -190K

PRIOR : -263K

REVISED : -219K

SURVEY : -175K (Mean: -175K, High: -105K, Low: -250K)

Average Weekly Hours (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 33.0

PRIOR : 33.0

REVISED : - -

SURVEY : 33.1 (Mean: 33.1, High: 33.1, Low: 33.0)

The unemloyment rate climed to 10.2% in October, a number not seen in over 26 years. Nonfarm payrolls dropped by 190,000, bringing the total number of jobs lost in the recession to 7.3 million. Economists estimated an unemployment rate of 10%, with 150,000 lost jobs in October. If you include discouraged workers and those forced to work part-time, the estimated rate is 17.5% unemployment.

Futures were down slightly after the announcement.

Wednesday, November 4, 2009

Quote of the Day

Monday, November 2, 2009

Quote of the Day

Jobs Saved? What About the Jobs Destroyed?

White House officials said the reports -- the first batch of filings by states, cities and other recipients of stimulus grants and loans -- buttressed their calculation that the full $787 billion package passed in February has saved or created 1 million jobs.

From Henry Hazlitt's 'Economics in One Lesson' (originally published in 1946), Chapter 4 'Public Works Mean Taxes:'

There is no more persistent and influential faith in the world today than the faith in government spending. Everywhere government spending is presented as a panacea for all our economic ills. An enormous literature is based on this fallacy, and, as so often happens with doctrines of this sort, it has become part of an intricate network of fallacies that mutually support each other.

A certain amount of public spending is necessary to perform essential government functions. A certain amount of public works — of streets and roads and bridges and tunnels, of armories and navy yards, of buildings to house legislatures, police and fire departments—is necessary to supply essential public services. With such public works, necessary for their own sake, and defended on that ground alone, I am not here concerned. I am here concerned with public works considered as a means of “providing employment” or of adding wealth to the community that it would not otherwise have had.

A bridge is built. If it is built to meet an insistent public demand, if it solves a traffic problem or a transportation problem otherwise insoluble, if, in short, it is even more necessary to the taxpayers collectively than the things for which they would have individually spent their money had it had not been taxed away from them, there can be no objection. But a bridge built primarily “to provide employment” is a different kind of bridge.

The bridge has to be paid for out of taxes. For every dollar that is spent on the bridge a dollar will be taken away from taxpayers. If the bridge costs $10 million the taxpayers will lose $10 million. They will have that much taken away from them which they would otherwise have spent on the things they needed most.

Therefore, for every public job created by the bridge project a private job has been destroyed somewhere else. We can see the men employed on the bridge. We can watch them at work. The employment argument of the government spenders becomes vivid, and probably for most people convincing. But there are other things that we do not see, because, alas, they have never been permitted to come into existence. They are the jobs destroyed by the $10 million taken from the taxpayers. All that has happened, at best, is that there has been a diversion of jobs because of the project. More bridge builders; fewer automobile workers, television technicians, clothing workers, farmers.

Thanks to Dennis Gartman, who featured a quote from this chapter of Economics in One Lesson in today's The Gartman Letter.

Steve: Not to mention, if one-third of the $787 billion was spent to save/create 1 million jobs, that comes out to about $259,710 per job. Sounds like inefficiency to me since probably none of those jobs paid a salary of $259,710.

Wednesday, October 28, 2009

Announcing Google Maps Navigation for Android 2.0

Today we're excited to announce the next step for Google Maps for mobile: Google Maps Navigation (Beta) for Android 2.0 devices.

This new feature comes with everything you'd expect to find in a GPS navigation system, like 3D views, turn-by-turn voice guidance and automatic rerouting. But unlike most navigation systems, Google Maps Navigation was built from the ground up to take advantage of your phone's Internet connection.

Here are seven features that are possible because Google Maps Navigation is connected to the Internet:

The most recent map and business data

When you use Google Maps Navigation, your phone automatically gets the most up-to-date maps and business listings from Google Maps — you never need to buy map upgrades or update your device. And this data is continuously improving, thanks to users who report maps issues and businesses who activate their listings with Google Local Business Center.

Search in plain English

Google Maps Navigation brings the speed, power and simplicity of Google search to your car. If you don't know the address you're looking for, don't worry. Simply enter the name of a business, a landmark or just about anything into the search box, and Google will find it for you. Then press 'Navigate', and you're on your way.

Search by voice

Typing on a phone can be difficult, especially in the car, so with Google Maps Navigation, you can say your destination instead. Hold down the search button to activate voice search, then tell your phone what you want to do (like 'Navigate to Pike Place in Seattle'), and navigation will start automatically.

Traffic view

Google Maps Navigation gets live traffic data over the Internet. A traffic indicator light in the corner of the screen glows green, yellow or red, depending on the current traffic conditions along your route. If there's a jam ahead of you, you'll know. To get more details, tap the light to zoom out to an aerial view showing traffic speeds and incidents ahead. And if the traffic doesn't look good, you can choose an alternate route.

Search along route

For those times when you're already on the road and need to find a business, Google Maps Navigation searches along your route to give you results that won't take you far from your path. You can search for a specific business by name or by type, or you can turn on popular layers, such as gas stations, restaurants or parking.

Satellite view

Google Maps Navigation uses the same satellite imagery as Google Maps on the desktop to help you get to your destination. Turn on the satellite layer for a high-resolution, 3D view of your upcoming route. Besides looking cool, satellite view can help you make sense of complicated maneuvers.

Street View

If you want to know what your next turn looks like, double-tap the map to zoom into Street View, which shows the turn as you'll see it, with your route overlaid. And since locating an address can sometimes be tricky, we'll show you a picture of your destination as you approach the end of your route, so you'll know exactly what to look for.

Since there's nothing quite like seeing the product in action, we made this video to demonstrate a real-life example:

The first phone to have Google Maps Navigation and Android 2.0 is the Droid from Verizon. Google Maps Navigation is initially available in the United States. And like other Google Maps features, Navigation is free.

Visit google.com/navigation to learn more and browse a gallery of product screenshots. Take Google Maps Navigation for a spin, and bring Internet-connected GPS navigation with you in your car.

Posted by Keith Ito, Software Engineer

Steven: Now this looks awesome. I'm sure a version for iPhone and other adroid builds are in the works.

Quote of the Day

Tuesday, October 27, 2009

Google Voice with your existing number

Previously, when you created a Google Voice account, we asked you to select a new Google phone number. This allowed us to offer features like call forwarding, screening, and recording. But we know not everyone wants to start using a new phone number, so we've been working on another option for people who are willing to trade some features for the ability to keep their existing number.

We're excited to announce that you now can get Google Voice with a Google number OR with your existing mobile phone number. If you choose to use Google Voice with your existing number, you won't get some features (like call screening and recording), but you'll still get many others -- including Google voicemail:

More specifically, if you sign up for Google Voice with your existing number, you'll get:

- Online, searchable voicemail

- Free automated voicemail transcription

- Custom voicemail greetings for different callers

- Email and SMS notifications

- Low-priced international calling

- One number that reaches you on all your phones

- SMS via email

- Call screening

- Listen In

- Call recording

- Conference calling

- Call blocking

If you already use Google Voice, you can add Google voicemail to any mobile phone you've linked to your account. If you're not using Google Voice yet, you can request an invitation or ask someone with a Google Voice account to invite you. When you receive the invitation to sign-up, you decide whether you'd like to use Google Voice with your existing number or get a Google number.

Posted by Pierre Lebeau, Product Manager

Steve: I love Google Voice. It's like having an assistant.

Monday, October 26, 2009

Why Not Cut Taxes and Spending?

Top Obama economic advisor Christy Romer delivered a very gloomy forecast to Congress late last week. She said that unemployment will remain at a “severely elevated level” and that the U.S. jobs market will stay painfully weak next year. She was just being honest. Romer even said the Obama stimulus plan will not contribute much to economic growth next year.

So the administration is searching for a jobs-recovery plan, just like the rest of the country. Meanwhile, big-government spending and temporary tax credits have not worked, by the administration’s own admission. That’s basically what Ms. Romer was saying.

So why not try something different? Why not go for lower tax rates across-the-board on individuals, businesses, and investors? Why not go for permanent tax cuts that will create new growth incentives? To paraphrase economist Art Laffer, if it pays more, after tax, to work, produce, and invest, folks will work, produce, and invest more. It’s worked in the past. And I believe it will work again.

Incidentally, this idea of cutting spending and cutting tax rates is attracting a lot of attention in many of the key state races right now — like the governor’s race in New Jersey, where unemployment is also hovering around 10 percent. The idea is also looming large in Virginia, as well as in some of the early skirmishing in California.

If it’s happening in the states, when will Washington finally get the message?

Friday, October 23, 2009

Quote of the Day

Wednesday, October 21, 2009

Quote of the Day

“When a man spends his own money to buy something for himself, he is very careful about how much he spends and how he spends it. When a man spends his own money to buy something for someone else, he is still very careful about how much he spends, but somewhat less what he spends it on. When a man spends someone else’s money to buy something for himself, he is very careful about what he buys, but doesn’t care at all how much he spends. And when a man spends someone else’s money on someone else, he does’t care how much he spends or what he spends it on. And that’s government for you.”

~ Milton Friedman

Friday, October 16, 2009

Bond Market's Expectation of Inflation: Only 1.75%

After an unusual period in late 2008 resulting in a narrowing spread when the TIPS 10-year yields were unusually high and approaching 3%, and regular Treasury yields were unusually low and approaching 2%, the Treasury market seems to have stabilized, and the bond market's 10-year expectation of inflation is now around 1.75%, lower than the inflationary expectations from 2003-2007 of around 2.5%.

Many analysts and economists seem to be worried about future inflation, resulting from the easy Fed monetary policy in 2008 (which has also contributed to a falling dollar). Apparently the bond mark doesn't necessarily share those concerns. According to the inflationary expectations derived from the bond market, future inflation is less of concern now in 2009 than it was during the 2003-2007 period.

“Inequality” and Fairness

Are market-generated differences in income unfair? Nope.

"Steve: This is a great article.

Thursday, October 15, 2009

Jobless Claims (4Wk. Avg.) Fall to Lowest Level in 38 Weeks, Down 119,000 (-19.3%) From April Peak

WASHINGTON (Reuters) - The number of U.S. workers filing new claims for jobless insurance unexpectedly fell last week to the lowest level since January, according to a government report on Thursday that hinted at stabilization in the labor market.

WASHINGTON (Reuters) - The number of U.S. workers filing new claims for jobless insurance unexpectedly fell last week to the lowest level since January, according to a government report on Thursday that hinted at stabilization in the labor market.Initial claims for state unemployment benefits fell 10,000 to a seasonally adjusted 514,000 in the week ended October 10, the Labor Department said. New jobless claims have declined for five of the last six weeks. The four-week moving average for new claims dipped 9,000 to 531,500 last week, declining for a sixth straight week (see top chart above).

MP: From the early April peak of 658,750, jobless claims (four-week average) have fallen by 127,250 to 531,500 (-18%), and that measure of jobless claims has fallen in 21 out of the last 27 weeks, including the last six months in a row. Jobless claims are now at the lowest level since January 17, 38 weeks ago. The bottom chart above shows that the 19% decline in jobless claims since the peak in April is consistent with the similar drops that marked the end of the 1990-91 recession (-15%) and the 2001 recession (-19%).

Great Review of Sprint's Android Phone at Android Central

I love the phone so far, but I'm still learning it.

Northern Trust Focus Conference Takeaways

•There will be a feeble recovery with housing leading (most affordable in 40 years and he thinks sales have bottomed).

•Consumer spending has stabilized

•Exports have hit a record high (13% of GDP), the weak dollar has helped. The U.S. has “stolen” exports from Germany and Japan who have declining populations

•Capital expenditures declining at a slower pace

•Growth is all about emerging markets

•U.S. to become export demand economy

•EM consumers (especially China) will drive global growth

•The U.S. will have a jobless recovery

•GDP Growth will be too slow to re-employ the laid of workers very quickly (He expects unemployment to peak at 10.5% by mid 2010)

•The work week is at record lows

•Many jobs that were lost are not coming back

•40% of stimulus has been spent

•He is negative on commercial real-estate

•Lending among financial institutions is strong, but future losses will come from commercial real-estate

•He believes a move away from the dollar and to a basket of currencies to trade oil would have a limited impact on the dollar

•He thinks this would also be a mistake by countries who hold large amounts of dollars (i.e. China)

•Yields are low on U.S. treasuries (even given the increase in borrowing) are because of low consumer borrowing

•Does not see inflation until at least 2011

•Inflation must be fed by demand, no demand for products and labor

•Low money supply growth

•U.S. dollar weakening to due increased risk appetite

Jim McDonald – Chief Investment Strategist

•Developing economies will do better than developed economies due to stronger financial markets and institutions

•Inflation will be muted because of no wage pressures

Jason Desana Trennert – Chief Investment Strategist of Strategas Research

•Government spending to drive growth… until the bill comes due

•Consumers have hit a ceiling

•Overweight- Commodities, Materials, Consumer Staples, Health care

•Underweight – Consumer Discretionary, Utilites, Telecom

•He believes the next couple of quarters will be better than expected

•Referenced Japan’s “lost decade” and that there were 7 rallies of over 60% in that time frame

•Japan’s growth during that decade was dependent of the government’s spending and the U.S. could see that same outcome

•Compared 1982 to current times and pointed out how much worse it looked

•Thinks buy and hold is dead for now

•Average holding period for stocks has fallen from 8 years in 1960 to 0.7 years in 2007

•Money market assets as a % of U.S. market capitalization are at 34%, much higher than the historical average of around 12%

Main Themes

•Extremely bullish on international (especially emerging markets) Northern Trust is now 50/50 domestic/international in its aggressive growth portfolio

•Still bullish on stocks in general

•No one is worried about inflation, in the near term

Wednesday, October 7, 2009

Gold (Inflation Adjusted)

Gold (Inflation Adjusted): "

While everyone seems to be all abuzz over Gold’s new highs, you should be aware that these are nominal, not real highs.

Adjusted for Inflation, Gold is nowhere near its all time peak — in real terms, its only about half its prior highs:

courtesy of Bianco Research

"

*Click to enlarge.

Steve: I thought this was an interesting chart to share. It puts the price of gold in perspective.

How Do We Keep Gov't. Honest? Medicare Denies More Inusrance Claims Than the Private Sector

How Do We Keep Gov't. Honest? Medicare Denies More Inusrance Claims Than the Private Sector: "

The purpose of the American Medical Association's '2008 National Health Insurer Report Card' is to provide physicians and the general public a reliable and defensible source of critical metrics concerning the timeliness, transparency and accuracy of claims processing by the health insurance companies that are responsible for paying these claims. Billions of dollars in administrative waste would be eliminated each year if third party-payers sent a timely, accurate and specific response to each physician claim.

The purpose of the American Medical Association's '2008 National Health Insurer Report Card' is to provide physicians and the general public a reliable and defensible source of critical metrics concerning the timeliness, transparency and accuracy of claims processing by the health insurance companies that are responsible for paying these claims. Billions of dollars in administrative waste would be eliminated each year if third party-payers sent a timely, accurate and specific response to each physician claim.An analysis of almost 10,000,000 insurance claims by the AMA to seven private insurance companies and Medicare between March 2007 and March 2008 reveals that more than half a million (574,591) claims were denied, and the chart above displays the percentage of claims denied by each insurer during that period. Medicare led the group with the greatest percentage of insurance claims denied (6.85%), more than double the denial rate for private insurers like UHC (2.7%), Coventry (2.9%), Humana (2.9%) and CIGNA (3.4%).

David Weinberger writes yesterday on the The Heritage Foundation Blog that:

The Obama administration repeats ad nauseum that we need a government option to “keep insurance companies honest” and to make sure they don’t deny anyone coverage. Well what does one say about the fact that Medicare denies more claims than private insurers?

Memoirs of a Minyan

Minyanville.com is a great financial education website.

In Defense of Capitalism: A True Love Story

Vitaliy N. Katsenelson, CFA submits:

Vitaliy N. Katsenelson, CFA submits: My writing is a byproduct of my investment process, I think through writing. I don’t do movie reviews and don’t watch Michael Moore’s movies. A Denver Post reporter invited me to a private showing of Moore’s latest flick last Monday Capitalism: a Love Story, it stirred up a lot of memories and I recently finished reading Atlas Shrugged which had a great impact on me. A combination of all those things motivated me to write this.

In the 1980s, in Soviet Russia, a few times a year, my class walked to a movie theater, where we were shown a documentary. Attendance was mandatory. The documentaries were different but the themes were the same: to the accompaniment of patriotic music, we learned about the righteousness of socialism, the greatness of Mother Russia, and the intelligence and foresight of our great leaders. To demonstrate how good we had it, we were shown images of “decaying” American capitalism. Of course, capitalism did not get the benefit of patriotic music as we were shown the poverty-stricken homeless, the KKK burning crosses and lynching blacks, and Russia-hating capitalists being poisoned by hamburgers (of course, later I learned this part about hamburgers was not a complete lie).

Complete Story »"

Monday, October 5, 2009

Capitalism: The Real Story

The data show that capitalism has actually done a lot for Michael Moore, and the millions of others living in countries with higher levels of economic freedom and capitalism. In fact, among many other benefits illustrated in the charts below, just being born in America added almost 20 years to Michael Moore's life expectancy compared to if he had been born in one of the countries in the bottom quartile of economic freedom (the 25% 'least free' countries in the world), see the first chart below.

Steve: I'll see Capitalism: A Love Story just for a few laughs. Captitalism is the best path to prosperity.

Friday, October 2, 2009

Post Office Version of the Big Three "Jobs Bank"

Post Office Version of the Big Three "Jobs Bank": "

It’s a practice called “standby time,” and it has existed for years — but postal employees say it was rarely used until this year. Now, postal officials say, the agency is averaging about 45,000 hours of standby time every week — the equivalent of having 1,125 full-time employees sitting idle, at a cost of more than $50 million per year.

Mail volume is down 12.6 percent compared with last year, and many postal supervisors simply don’t have enough work to keep all employees busy. But a thicket of union rules prevents managers from laying off excess employees; a recent agreement with the unions, in fact, temporarily prevents the Postal Service from even reassigning them to other facilities that could use them. So they sit — some for a few hours, others for entire shifts. Postal union officials estimate some 15,000 employees have spent time on standby this year.

HT: Paul Ringstrom

Thursday, October 1, 2009

Public Option = Massive Income Redistribution

Young adults remain some of the strongest supporters of a health-care overhaul, but many acknowledge they don't understand proposals that will likely saddle them with higher costs.

In the latest Wall Street Journal/NBC News poll, 18- to 34-year-olds showed some of the same apprehension as other age groups when asked whether President Barack Obama's health-care plan was a good idea. But half in that age group said they support a public insurance option, one of the most controversial elements of some of the proposals, with 43% opposed. It was the only age group in which more respondents supported than opposed a public option.

At the same time, the poll suggested many young adults didn't know what was in the legislation, with 48% saying they didn't understand or understood only somewhat what was being debated. That compared with 40% for respondents aged 65 and over.

MP: Before they throw their support so strongly behind a public insurance option, young adults might want to better understand the huge, inter-generational income redistribution that might be imposed on them if the public option passes, as outlined in these two recent reports:

From the Washington Post article (9/16/2009) “Young Adults Likely to Pay Big Share of Reform's Cost”:

As health-care legislation advances through Congress, the young adults who were so vital to President Obama's election are emerging as a significant beneficiary of his top domestic priority, but they are also likely to play a major role in funding any reform.

Drafting young adults into any health-care reform package is crucial to paying for it. As low-cost additions to insurance pools, young adults would help dilute the expense of covering older, sicker people. Depending on how Congress requires insurers to price their policies, this group could even wind up paying disproportionately hefty premiums -- effectively subsidizing coverage for their parents.

From the Wall Street Journal article (9/27/2009) “Health 'Reform' Is Income Redistribution”:

Like the homeowner who waits until his house is on fire to buy insurance, younger, poorer, healthier workers will rationally choose to avoid paying high premiums now to subsidize insurance for someone else. After all, they can always get a policy if they get sick.

To avoid this outcome, most congressional Democrats and some Republicans would combine guaranteed issue and community rating with the requirement that all workers buy health insurance—that is, an 'individual mandate.' This solves the incentive problem, and guarantees that both the healthy poor 25-year-old and the sick higher-income 55-year-old have heath insurance.

But the combination of a guaranteed issue, community rating and an individual mandate means that younger, healthier, lower-income earners would be forced to subsidize older, sicker, higher-income earners. And because these subsidies are buried within health-insurance premiums, the massive income redistribution is hidden from public view and not debated.

Jobless Claims (4Wk. Avg.) Fall to Lowest Level in 36 Weeks, Down 110,750 From Early April Peak

WASHINGTON — First-time claims for jobless benefits increased more than expected last week, a sign employers are reluctant to hire and the job market remains weak. And while consumer spending jumped by the most in nearly eight years in August due partly to the government's Cash for Clunkers program, economists worry whether that rebound can be sustained with U.S. households facing rising unemployment, tight credit conditions and other obstacles.

The Labor Department said Thursday that initial claims for unemployment insurance rose to a seasonally adjusted 551,000 from 534,000 in the previous week. Wall Street economists expected an increase of 5,000, according to a survey by Thomson Reuters.

The increase comes after three weeks of declines. Weekly claims have been trending down since the spring, but the decline has been painfully slow. The four-week average, which smooths out fluctuations, dropped to 548,000, about 110,000 below its peak in early April (see chart above).

MP: From the peak in early July, the four-week average has fallen by 110,750, and that measure of jobless claims has fallen in 19 out of the last 25 weeks. A comparison of the recent 110,750 decline to the last two recessions in the chart above, suggests that claims have been falling pretty sharply, and not 'painfully slow,' especially compared to the 1990-1991 recession.

Economic Alert

ACTUAL : 551K

PRIOR : 530K

REVISED : 534K

SURVEY : 535K (Mean: 534K, High: 555K, Low: 519K)

First-time claims for state unemployment benefits rose for the first time in four weeks. The number of initial claims rose 17,000 to 551, 000 for the week ending Sept. 26. The four-week average fell 6,250 to 548,000. This is the lowest level for the average since Jan. 24.

Continuing Claims (United States) {US}OBSERVATION PERIOD: SEP 19 (Weekly)

ACTUAL : 6090K

PRIOR : 6138K

REVISED : 6160K

SURVEY : 6170K (Mean: 6179K, High: 6330K, Low: 6100K)

The number of people receiving jobless benefits fell 70,000 to 6.09 million in the week ending Sept. 19. The four-week moving average of continuing claims fell 39,250 to 6.15 million.

47% will pay no federal income tax

According to CNNMoney.com:

In 2009, roughly 47% of households, or 71 million, will not owe any federal income tax, according to estimates by the nonpartisan Tax Policy Center.

Some in that group will even get additional money from the government because they qualify for refundable tax breaks.

Steve: Fair taxation?

Wednesday, September 30, 2009

Why Not Eliminate the Cap-Gains Tax for Everyone? -- By: Larry Kudlow

The Case-Shiller home-price index increased yesterday for the third month in a row. That’s terrific news. After a 40 to 50 percent drop in home prices in recent years, sales are picking up, because prices are way down. That’s also great. Markets work.

But here’s what I don’t like about this story: Big, central-planning, government-directed tax preferences for housing, like the $8,000 dollar tax credit for new buyers. Or even the popular mortgage interest deduction. And let’s not forget perhaps the biggest one of all: Home sales are basically capital-gains-tax free. That passed back in 1997. Many people (including myself) believe it helped create the bubble.

Why not eliminate the capital-gains tax for everyone and all sectors, including investors and stocks and bonds? Why direct it only to housing? Let’s abolish the capital-gains tax altogether. Let’s quit double-taxing investment, which is what capital gains does. But let’s do it for everyone and everything -- not just housing. While we’re giving all these preferences to housing, what about manufacturing? What about transportation? Or health care? Or any other sector in the economy for that matter?

We also could be cutting business tax rates across-the-board for companies big and small.

And for all individuals and businesses, why not a simple, low, flat-rate tax? Somewhere between 15 and 20 percent? Get rid of all of the special preferences and deductions in the code. Stop favoring one sector at the expense of the others. Incidentally, this would stop the corruption of K-Street lobbyists who love to get these preferences in there.

Let’s make the tax code simple, fair, and pro-growth, to unleash prosperity. Let’s stop the political direction of the economy, and let’s substitute a market direction of the economy. A true flat tax would do it.

If you get to keep more of what you earn and invest at the lower tax rate -- if you tax something less -- you’ll get more of it. If you tax the whole economy less -- not just housing, but the entire economy -- you will get a much more prosperous and healthier economy. At a time when we’re all worried about economic growth, we ought to be thinking hard about this.

"

Steve: I like his thinking!

Tuesday, September 29, 2009

Quote of The Day

Protectionists are Profoundly Confused

In a letter appearing in Sunday’s Washington Times, protectionist William Hawkins accuses Adam Smith of being “dreadfully wrong” to insist that the ultimate goal of economic activity is consumption rather than production.

Alas, the dreadfully wrong one is Hawkins. He confuses means with ends. Flour, sugar, apples, an oven, and labor are necessary ingredients for baking an apple pie, but these means are valuable in this use only if someone wants to consume the pie. If no one wants to eat apple pie, then using these ingredients to produce the pie would be wasteful.

Adam Smith correctly understood that the desire to consume is what justifies production, and not vice-versa. If Mr. Hawkins were correct that the ultimate goal of economic activity is production, then he should be just as pleased to have set before him for dessert a fresh-from-the-oven sawdust-and-earthworm pie as he is to have an apple pie.

"

Steve: This is a good explaination of what is wrong with protectionist thinking. We have to produce things that people actually desire, otherwise we are wasting resources that could be used elsewhere. Just producing things to keep people busy, is unproductive.

Centering the allocation of resources based on production will lead to shortages for desired goods and surpluses of undesirable goods.

Monday, September 28, 2009

One Reason European Health Care Works: America

So socialist Europe, by using American drugs is profiting from good old-fashioned American free enterprise. the lesson is to be skeptical of reports speaking glowingly of socialized health-care systems [MP: Example here of a report cited earlier in this article], because those systems wouldn’t work nearly as well as they do without unsocialized American medicine.

~From 'The Pharmaceutical Umbrella,' by Benjamin A. Plotinsky in City Journal

HT: Art Little

Quote of The Day

Friday, September 25, 2009

Quote of The Day

Interesting Take on The Economy From Mark J. Perry

We are not even yet anywhere close to the economic conditions of that period. For example, the prime rate was more than six times higher in 1980 compared to today, core inflation in 1980 was six times higher than today, the unemployment rate in November and December of 1982 was more than a percentage point higher than the August 2009 rate, the 30-year mortgage rate in 1981 was almost four times higher than today’s 5 percent, the car loan rate in 1981 was 2.5 times higher than today, and real gas prices were 32 percent more expensive in 1981 than today. So before we start talking about the “worst economy since the 1930s” couldn’t we first look at the early 1980s as a benchmark of how bad economic conditions can get, using a more recent period?

And consider that as bad as the economic conditions were back in the early 1980s, the U.S. economy started on an economic expansion in November of 1982 that didn’t end until July 1990, 92 months later, and marked the third longest expansion in U.S. history. Given the current environment with historically low interest rates and inflation, today’s economic and financial conditions are much more favorable for economic growth than the conditions of the early 1980s. If the economy of the early 1980s recovered even when handicapped with historically high interest rates and inflation, today’s economy is much better positioned for what Larry Kudlow calls the pending “barnburning economic recovery.”

Originally posted by Mark J. Perry at the Enterprise Blog.

Thursday, September 24, 2009

Quote of The Day

“Another bunch of ignorant bull**** about your children: school uniforms. Bad theory! The idea that if kids wear uniforms to school, it helps keep order. Hey! Don’t these schools do enough damage makin’ all these children think alike? Now they’re gonna get ‘em to look alike, too?

And it’s not even a new idea; I first saw it in old newsreels from the 1930s, but it was hard to understand, because the narration was in German! But the uniforms looked beautiful. And the children did everything they were told and never questioned authority. Gee, I wonder why someone would want to put our children in uniforms. Can’t imagine.”

~ George Carlin

Jobless Claims Declined

ACTUAL : 530K

PRIOR : 545K

REVISED : 551K

SURVEY : 550K (Mean: 548K, High: 565K, Low: 510K)

Continuing Claims (United States) {US} OBSERVATION PERIOD: SEP 12 (Weekly)

ACTUAL : 6138K

PRIOR : 6230K

REVISED : 6261K

SURVEY : 6183K (Mean: 6169K, High: 6250K, Low: 6100K)

The number of workers filing new claims for jobless benefits unexpectedly declined last week. Also, continuing claims were down.

Initial claims fell 21,000 to 530,000 in the week ending Sept. 19. Economist expected an increase of 5,000.

Continuing claims, which are claims drawn by workers for more than one week, fell by 123,000 to 6,138,000 from the prior week's revised level of 6,261,000.

The unemployment rate ending Sept. 12 fell by 0.1% to 9.6%.

Wednesday, September 23, 2009

Volatility at 1-Yr. Low, Financial Conditions at 2-Yr. High

Tuesday, September 22, 2009

Google Sync: Now with push Gmail support

Using Google Sync, you can now get your Gmail messages pushed directly to your phone. Having an over-the-air, always-on connection means that your inbox is up to date, no matter where you are or what you're doing. Sync works with your phone's native email application so there's no additional software needed. Only interested in syncing your Gmail, but not your Calendar? Google Sync allows you to sync just your Contacts, Calendar, or Gmail, or any combination of the three.

To try Google Sync, visit m.google.com/sync from your computer. If you're already using Google Sync, learn how to enable Gmail sync. Since push Gmail has been a popular request on our Product Ideas page and Help Forum, we look forward to hearing your feedback, so drop us a line and let us know how it's working or what you'd like to see next.

Steve: One more reason to get the iPhone. I just wish AT&T got better service where I live. I might just hold off for a little bit. Sprint gets the HTC Hero next month, it looks pretty sweet, and has the android OS.