Every aspect of our lives is fueled by markets. Market Fueled is a compilation of market driven ideas and knowledge. It will consist of shared posts and links from my favorite blogs, articles, and some of my own ideas. The focus of the blog will be economics, financial markets, politics, and technology.

Wednesday, November 25, 2009

Economic Alert

ACTUAL : 466K

PRIOR : 505K

REVISED : 501K

SURVEY : 500K (Mean: 496K, High: 512K, Low: 460K)

Continuing Claims (United States) {US} OBSERVATION PERIOD: NOV 14 (Weekly)

ACTUAL : 5423K

PRIOR : 5611K

REVISED : 5613K

SURVEY : 5565K (Mean: 5559K, High: 5630K, Low: 5400K)

Personal Income (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 0.2%

PRIOR : 0.0%

REVISED : 0.2%

SURVEY : 0.1% (Mean: 0.1%, High: 0.4%, Low: -0.2%)

Personal Spending (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 0.7%

PRIOR : -0.5%

REVISED : -0.6%

SURVEY : 0.5% (Mean: 0.5%, High: 0.8%, Low: 0.0%)

Durable Goods Orders (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -0.6%

PRIOR : 1.0%

REVISED : 2.0%

SURVEY : 0.5% (Mean: 0.5%, High: 2.1%, Low: -1.0%)

Durables Ex Transportation (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -1.3%

PRIOR : 0.9%

REVISED : 1.8%

SURVEY : 0.7% (Mean: 0.7%, High: 1.5%, Low: -0.6%)

The number of initial unemployment claims dropped to a seasonally adjusted 466,000 in the week ending Nov. 21. This marks the lowest level of filings for initial claims in over a year, finally breaking the 500,000 mark. Continuing claims were also below analyst expectations. They came in at 5,423,000 compared to an estimated 5,565,000. Some of which may be attributable to seasonal part-time employment.

Personal income rose 0.2% for the second straight month, slightly better than expected. Spending increased 0.7% for the month, showing that the consumer is still spending despite the unclear future of the economy. Personal spending grew faster than income, therefore Americans' personal savings rate dipped to 4.4% in October from 4.6% in September.

However, the durable goods order was somewhat disappointing. New orders for durable (long-lasting) U.S. manufactured goods fell in october. Durable good orders are a leading indicator of manufacturing activity.

Tuesday, November 24, 2009

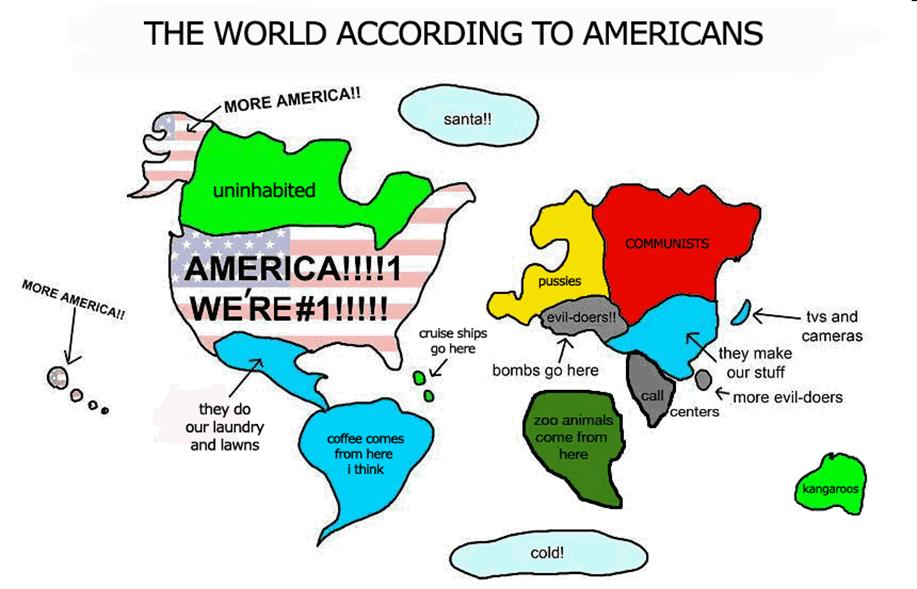

The World According to Americans

This got big laughs in Berlin (despite the description of Europe)

>

Hat tip Prieur!

Hat tip Prieur!

>

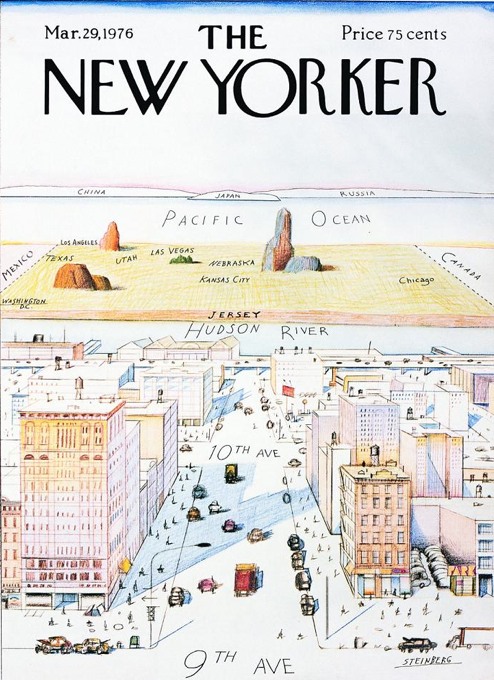

Not to be confused with Saul Steinberg’s New Yorker cover (March 29, 1976) “View of the World from 9th Avenue.”

"

Thursday, November 19, 2009

Leading Indicators Rise for 7th Month to 2-Yr. High

Details:

Six of the ten indicators that make up The Conference Board LEI for the U.S. increased in October. The positive contributors – beginning with the largest positive contributor – were the interest rate spread, average weekly initial claims for unemployment insurance (inverted), stock prices, average weekly manufacturing hours, real money supply and manufacturers’ new orders for consumer goods and materials. The negative contributors – beginning with the largest negative contributor – were index of consumer expectations, building permits, index of supplier deliveries (vendor performance), and manufacturers’ new orders for nondefense capital goods.

Wednesday, November 18, 2009

Baltic Dry Index Roars Back: 102.5% Gain in 39 Days

Baltic Dry Index Roars Back: 102.5% Gain in 39 Days: "

The Baltic Dry Index closed today at 4381, advancing for the 14th straight day, and registering positive gains in 31 out the last 35 days. From the late-September low of 2163, the benchmark index for freight costs to ship dry bulk commodities such as iron ore, coal and grains has more than doubled in just 39 days, and has reached the highest level since September 24, 2008, almost 14 months ago. The global economic recovery is underway and gaining momentum.

The Baltic Dry Index closed today at 4381, advancing for the 14th straight day, and registering positive gains in 31 out the last 35 days. From the late-September low of 2163, the benchmark index for freight costs to ship dry bulk commodities such as iron ore, coal and grains has more than doubled in just 39 days, and has reached the highest level since September 24, 2008, almost 14 months ago. The global economic recovery is underway and gaining momentum.See related post here from Scott Grannis, who says that:

Clearly, the wheels of global commerce are spinning back up. Everything I see is consistent with a global recovery in confidence, in demand, and in production.

Sunday, November 15, 2009

The "Good Old Days" Are Now and It Gets Better All the Time, Thanks to Free-Market Capitalism

From the BLS report '100 Years of U.S. Consumer Spending':

From the BLS report '100 Years of U.S. Consumer Spending':

1. The material well-being of families in the United States improved dramatically, as demonstrated by the change over time in the percentage of expenditures allocated for food, clothing, and housing. In 1901, the average U.S. family devoted 79.8 percent of its spending to these necessities. By 2002–03, allocations on necessities had been reduced substantially, for U.S. families to 50.1% of spending (see top chart above).

2. The continued and significant decline over the century in the share of expenditures allocated for food also reflected improved living standards. In 1901, U.S. households allotted 42.5% of their expenditures for food; by 2002–03, food’s share of spending had dropped to just 13.2%.

3. Over the 100-year period, expenditure shares for clothing steadily declined. In 1901, the average U.S. household allocated 14% of total spending for apparel. By 2002–03, spending shares for clothing had decreased to 4.2%.

4. In 2002–03, the average U.S. family could allocate about 50% ($20,333) of total expenditures for a variety of discretionary consumer goods and services, while the average family in 1901 could allocate only 20.2%, or $155, for discretionary spending (see bottom chart above).

Conclusion: Perhaps as revealing as the shift in consumer expenditure shares over the past 100 years is the wide variety of consumer items that had not been invented during the early decades of the 20th century but are commonplace today. In the 21st century, households throughout the country have purchased computers, televisions, iPods, DVD players, vacation homes, boats, planes, and recreational vehicles. They have sent their children to summer camps; contributed to retirement and pension funds; attended theatrical and musical performances and sporting events; joined health, country, and yacht clubs; and taken domestic and foreign vacation excursions. These items, which were unknown and undreamt of a century ago, are tangible proof that U.S. households today enjoy a higher standard of living.

MP: As I wrote in a previous post: Teenagers today can afford products today like cell phones with cameras, digital cameras, GPS systems, CD players, DVD players, laptop computers, and iPods that even a billionaire couldn't have purchased 2 0 years ago. As much as we might complain, just by being alive in the 21st century America, even if you're earning the minimum wage, you've already 'won first prize in the lottery of life.'

HT: Lyle Meier

Friday, November 6, 2009

Public Option = Single Payer = Gov't. Monopoly

If the government has some magic way of reducing costs — rather than shifting them around, including shifting them to the next generation — they have certainly not revealed that secret. The actual track record of government when it comes to costs — of anything — is more alarming than reassuring.

2. Ironically, it is politicians who have already made medical insurance so expensive that many people refuse to buy it. Insurance is designed to cover risk. But politicians have mandated that insurance cover things that are not risks and that neither the buyers nor the sellers of insurance want covered.

In various states, medical insurance must cover the costs of fertility treatments, annual checkups and other things that have nothing to do with risks. What many people most want is to be insured against the risk of having their life's savings wiped out by a catastrophic illness. But you cannot get insurance just for catastrophic illnesses when politicians keep piling on mandates that drive up the cost of the insurance. These are usually state mandates but the federal government is already promising more mandates on insurance companies — which means still higher costs and higher premiums.

All this makes a farce of the notion of a 'public option' that will simply provide competition to keep private insurance companies honest. What politicians can and will do is continue to drive up the cost of private insurance until it is no longer viable. A 'public option' is simply a path toward a 'single payer' system, a euphemism for a government monopoly.

~Thomas Sowell's latest column on the 'costs' of medical care.

Unemployment Rate Climbs

ACTUAL : 10.2%

PRIOR : 9.8%

REVISED : - -

SURVEY : 9.9% (Mean: 9.9%, High: 10.1%, Low: 9.8%)

Change in Nonfarm Payrolls (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : -190K

PRIOR : -263K

REVISED : -219K

SURVEY : -175K (Mean: -175K, High: -105K, Low: -250K)

Average Weekly Hours (United States) {US} OBSERVATION PERIOD: OCT (Monthly)

ACTUAL : 33.0

PRIOR : 33.0

REVISED : - -

SURVEY : 33.1 (Mean: 33.1, High: 33.1, Low: 33.0)

The unemloyment rate climed to 10.2% in October, a number not seen in over 26 years. Nonfarm payrolls dropped by 190,000, bringing the total number of jobs lost in the recession to 7.3 million. Economists estimated an unemployment rate of 10%, with 150,000 lost jobs in October. If you include discouraged workers and those forced to work part-time, the estimated rate is 17.5% unemployment.

Futures were down slightly after the announcement.

Wednesday, November 4, 2009

Quote of the Day

Monday, November 2, 2009

Quote of the Day

Jobs Saved? What About the Jobs Destroyed?

White House officials said the reports -- the first batch of filings by states, cities and other recipients of stimulus grants and loans -- buttressed their calculation that the full $787 billion package passed in February has saved or created 1 million jobs.

From Henry Hazlitt's 'Economics in One Lesson' (originally published in 1946), Chapter 4 'Public Works Mean Taxes:'

There is no more persistent and influential faith in the world today than the faith in government spending. Everywhere government spending is presented as a panacea for all our economic ills. An enormous literature is based on this fallacy, and, as so often happens with doctrines of this sort, it has become part of an intricate network of fallacies that mutually support each other.

A certain amount of public spending is necessary to perform essential government functions. A certain amount of public works — of streets and roads and bridges and tunnels, of armories and navy yards, of buildings to house legislatures, police and fire departments—is necessary to supply essential public services. With such public works, necessary for their own sake, and defended on that ground alone, I am not here concerned. I am here concerned with public works considered as a means of “providing employment” or of adding wealth to the community that it would not otherwise have had.

A bridge is built. If it is built to meet an insistent public demand, if it solves a traffic problem or a transportation problem otherwise insoluble, if, in short, it is even more necessary to the taxpayers collectively than the things for which they would have individually spent their money had it had not been taxed away from them, there can be no objection. But a bridge built primarily “to provide employment” is a different kind of bridge.

The bridge has to be paid for out of taxes. For every dollar that is spent on the bridge a dollar will be taken away from taxpayers. If the bridge costs $10 million the taxpayers will lose $10 million. They will have that much taken away from them which they would otherwise have spent on the things they needed most.

Therefore, for every public job created by the bridge project a private job has been destroyed somewhere else. We can see the men employed on the bridge. We can watch them at work. The employment argument of the government spenders becomes vivid, and probably for most people convincing. But there are other things that we do not see, because, alas, they have never been permitted to come into existence. They are the jobs destroyed by the $10 million taken from the taxpayers. All that has happened, at best, is that there has been a diversion of jobs because of the project. More bridge builders; fewer automobile workers, television technicians, clothing workers, farmers.

Thanks to Dennis Gartman, who featured a quote from this chapter of Economics in One Lesson in today's The Gartman Letter.

Steve: Not to mention, if one-third of the $787 billion was spent to save/create 1 million jobs, that comes out to about $259,710 per job. Sounds like inefficiency to me since probably none of those jobs paid a salary of $259,710.